Jul 25, 2023

Well…If I really want to write just about generative AI use cases for Insurance Industry, the content can be autogenerated using widely available tools.

Example, if I ask chatGPT on “can you plz brief insurance use cases for generative AI“

The response says it all (provided at the end). That’s it my article is over.

The intention of this article is not to preach or consolidate the information already available over web with multiple blogs, articles, insights about the same.

But to make the CXO level and the decision makers to understand the Nuances of implementing it and calculating the ROI for going through that journey.

Today we are overloaded with too much information and too rapid changes, where we are missing the fundamentals in providing great service to our customers.

I still remember when I asked my technical head way back in 2017 stating that, “we need to implement AI”, the swift response is “Praveen ! you bring a business use case. If that can’t be solved through structural approach, we can do AI”.

Today most of the corporates are bringing the technology first and trying to find suitable business problem rather than other way round.

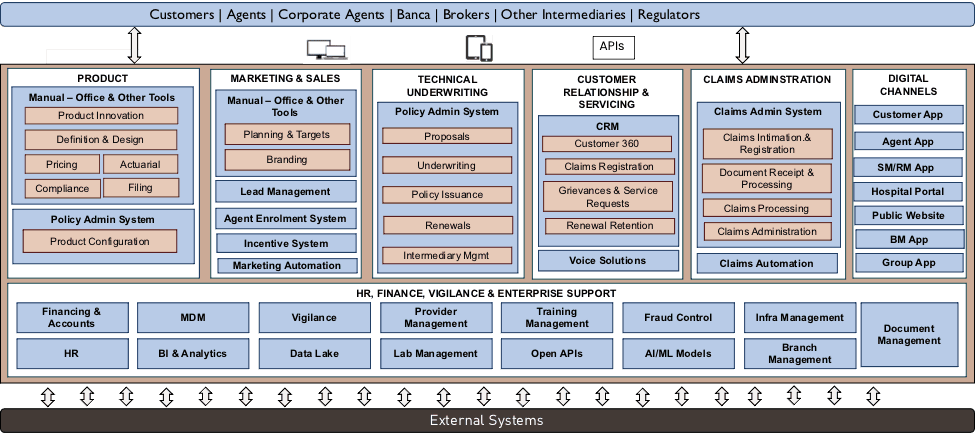

To make things clear and specific to insurance industry, I have given the basic insurance landscape below with my limited knowledge of working in the Industry for 4 years.

Before even going further on how we can apply generative AI, let’s first understand current customer challenges and what are the key interaction points.

It can be broadly classified as below:

1. Customer On-Boarding – Customer purchases insurance (payment made) & his/her details are captured in the system (Underwriting)

2. Claims – Supporting customer in case of any claims – cashless or reimbursement

3. Servicing & Grievances – Any service requests like change of address, member detail changes etc & grievances

4. Customer Retention – Renewals

Whatever other functions are there are primarily to support the above 4 key areas, be it digital marketing to help in point 1 or automated calling for point 4, automation for point 2 etc.

Though I couldn’t able to get exact statistics around the challenges faced by customers, broadly following are the key challenges faced by customers:

CUSTOMER ON-BOARDING

1. Mis-Selling -> customers are sold policies which are not suited to their needs.

2. Wrongful Declaration -> Some agents request clients to suppress their pre-medical conditions or other information that might impact their policy issuance. This results in either cancellation or non-payment of claims.

3. Payment Issues -> Customer’s account gets debited but policy not issued

4. Fresh Policy Instead of Renewal -> Most of the customers doesn’t know the continuity benefit and agents take that for advantage and do fresh purchase of policy instead of renewal resulting in loss of continuity benefits

5. Portability Policies -> People who would like to port their policy are not fully aware of all conditions and tend to mis few critical covers during portability or lose coverage period if there is any delay in the process. This is in Indian context.

CLAIMS

1. Customer Awareness – Customers doesn’t know about complex terminologies used, and what are the limits and sub limits. Things get ended up in disputes and losing customer’s trust or leading to grievances.

2. Cumbersome process of reimbursement – Though many insurance companies claim seamless claims reimbursement process, in reality customer has to go through painful reimbursement process with minimum lead time of one to two months of settling in clean case.

3. Inadequate Cashless facility – While most of the cashless are straight forward, there are still disputes related to limits set for different treatments and also the overall settlement of final bill takes more than half a day where customers need to wait for clearance. This is in Indian context.

PAYMENT ISSUES

1. Instant Payment -> Some companies collect payment first and then take the proposal details required to issue the policy. In this case, if there are any glitches, customer has no clue and his/her policy issuance is delayed.

2. Payment done but policy not issued -> In some cases, money will be debited from customer account but policy is not issued instantly. Typical case may take two to five days for resolution, for which customer is losing the cover.

3. Delta Payment – sometimes due to age bracket change customer is supposed to make additional premium payment, which is not seamless.

4. Banca Payments – Banca transactions are different, where the premium is debited directly in the customer’s bank account and the details are passed to the insurance company at the end of the day. If no proper reconciliation process is set, the customer has to wait for the issuance of policy.

WRONGFUL DECLARATION

1. PED (Pre-Existing Disease) -> Customer are not aware of significance of PEDs and end up not providing the required information only to find the policy being cancelled or claim not being honored.

2. Industry -> In case of Personal Accident the industry where person is working, plays a vital role in defining premium. Customer who tend to declare it wrongly will face challenges in claims.

RENEWALS

1. Fresh Policy Instead of Renewal – Customer end up buying policy as fresh instead of renewal to lack of knowledge

2. Grace Period Renewals -> Customers are not aware of implication of grace period renewals and benefits of paying premium on time.

Other than above key customer touch points, rest of the operations are around how to grow business and support the customers. These include but not limited:

1. Digital Marketing & Direct Business

2. Lead Management

3. Agent On-boarding

4. Distribution Channels

5. Incentive & Commission Management

6. Underwriting

7. Customer Support

8. Digital Channels

Now broadly mapping the problem statement/ challenges into applicability of generative AI, I would see the below use cases:

1. Customer Awareness -> From an Indian context and in particularly with Health Insurance, the very most challenge that customer face today is understanding it. Though there are multiple sites emerging today like ditto insurance who claim to address this issue, this is very pertaining in the Industry.

When I was trying to solve this problem, what I understood is from a policy document perspective there is no applicability of AI.

As policy document is single and there is no training data. So for understanding the clauses and detailing out to customer doesn’t need AI.

Where we can apply generative AI, is in terms of understanding pain points across multiple insurers, through web and working out a solution to address those specific needs.

Second one is generating relevant and specific information related to various medical conditions, procedures and tailor made these content based on customer and product. On top of that, add the benefits related to the policy purchased along with limits and sub-limit explanation.

2. Contextual Chatbot/VoiceBot -> Already multiple companies have implemented chat/voice bots. However with the technology advancement, much better experience can be provided by understanding the customer context and guiding them.

3. Marketing (Improve Conversion Rate & Focus Areas) -> Generative AI can be used to feed large sets of marketing data in terms of campaigns, target users and end results to get more insights about target segments and what kind of product can be sold to which segment. This significantly reduces the CAC (Customer Acquisition Cost) and improves the conversion rate.

4. Agent On-Boarding -> None of the blogs I went through have specified agent on-boarding as use-case. This is particularly useful in Indian context and specifically for health insurance. Most of the health insurance business is driven by agents in India and getting quality agents on-board will help insurance companies grow their business.

5. Product Innovation & Pricing -> This is where generative AI can come handy, if fed with actuarial data and the industry data related to claims, diseases etc to innovate new products and structure the price properly.

6. Claims Processing -> Auto adjudicating the claims by going through the discharge summary or authorization form for pre-authorization. This can help greatly in terms of reducing the overall TAT for claims processing.

‘m not covering the other use cases which can be found over the web & chatGPT.

Giving those references for further reading, if anyone is interested to explore other use cases.

Thanks for reading. Kindly share your feedback for further improvements in comments section.

Other References for further reading:

3. https://aisera.com/blog/chatgpt-generative-ai-in-insurance/

Question posted to chatGPT: “can you plz brief insurance use cases for generative AI?”

ChatGPT Response:

Certainly! Generative AI, such as the GPT-3.5 architecture that powers me, can be utilized in various insurance-related use cases. Here are some of the prominent applications:

Automated Customer Support: Insurance companies often receive numerous inquiries from policyholders and potential customers. Generative AI can be employed to develop chatbots and virtual assistants capable of understanding natural language and providing relevant and personalized responses to queries, claims status updates, policy details, and other customer-related concerns.

Underwriting Assistance: Generative AI can aid insurance underwriters in assessing risks and determining policy premiums. By analyzing vast amounts of data, including historical claims data, market trends, and customer information, AI models can generate risk profiles and provide insights for making informed underwriting decisions.

Claims Processing: Processing insurance claims can be time-consuming and complex. Generative AI can be utilized to streamline the claims process by extracting information from claim forms, assessing damage based on images and descriptions, and automating routine claim approvals for faster settlement.

Fraud Detection: Insurance fraud is a significant concern for the industry. Generative AI can be employed to analyze patterns in claims data and identify potential fraudulent activities. By recognizing irregularities or suspicious behavior, insurance companies can mitigate losses and enhance fraud prevention efforts.

Personalized Policy Recommendations: Generative AI can analyze customer data, such as age, location, lifestyle, and risk factors, to generate personalized insurance policy recommendations that cater to individual needs. This can improve customer satisfaction and increase policy uptake.

Risk Assessment and Management: Insurance companies can use generative AI to predict and model potential risks based on historical data and external factors. These predictive models can help insurers better understand their exposure to risk and design more comprehensive risk management strategies.

Natural Language Processing for Policy Analysis: Generative AI can read and analyze insurance policies, highlighting key terms, conditions, and exclusions, which can be beneficial for both customers and insurers. It ensures better transparency and allows customers to make informed decisions.

Product Development and Market Research: Insurance companies can use generative AI to gain insights into customer preferences and identify market trends. By analyzing customer feedback, social media interactions, and other relevant data, insurers can develop new insurance products tailored to customer demands.

Automated Underwriting and Quoting: Generative AI can streamline the insurance application process by automating underwriting and generating instant quotes based on customer inputs and data analysis. This expedites the policy issuance and purchasing experience.

Language Translation for Global Operations: For multinational insurance companies, generative AI can assist in translating policy documents, customer communications, and marketing materials into various languages, enabling efficient communication across different regions.

It's essential to note that while generative AI can bring numerous benefits to the insurance industry, its application requires careful consideration of ethical concerns, data privacy, and regulatory compliance. As with any AI-powered solution, maintaining transparency, fairness, and accountability is crucial for building trust and ensuring positive outcomes.